fanmal.ru

Gainers & Losers

Black Bra Under White Shirt

Our verdict: Seamless is the best bra for white shirts! While seamed bras do offer more support for larger busts, if you're after a sleek and smooth fit then. black bra tops for women going out. Related inspiration. Logo White · Browns · Beige · Reds · Pinks · Oranges · Yellows. Ivory. Greens · Blues. I have seen black bras and camis under semi-sheer white blouses and I actually like it. I'm not talking completely see-through fabric though, I've even seen a. The most comfortable bras for a supported yet barely-there look under t-shirts, designed for small busts. Technically they are considered "under garments" so it's "improper" if it's showing. That said I have no problem showing off skin. under a thin white t-shirt while sporting a small plaster on her left. A black bra is also not recommended, as it will show through the white shirt and create a stark contrast. Pastel colors should also be avoided, as they can be. Soft T-shirt bra for an invisible look under clothes. A T-shirt bra has Black. Beige. Dark Blue. White. Keep Fresh bra. Multiway straps. Buy. Keep Fresh bra. A bra in the color of your skin tone should be in every woman's wardrobe. Underneath white or light clothing it will essentially be undetectable. Our verdict: Seamless is the best bra for white shirts! While seamed bras do offer more support for larger busts, if you're after a sleek and smooth fit then. black bra tops for women going out. Related inspiration. Logo White · Browns · Beige · Reds · Pinks · Oranges · Yellows. Ivory. Greens · Blues. I have seen black bras and camis under semi-sheer white blouses and I actually like it. I'm not talking completely see-through fabric though, I've even seen a. The most comfortable bras for a supported yet barely-there look under t-shirts, designed for small busts. Technically they are considered "under garments" so it's "improper" if it's showing. That said I have no problem showing off skin. under a thin white t-shirt while sporting a small plaster on her left. A black bra is also not recommended, as it will show through the white shirt and create a stark contrast. Pastel colors should also be avoided, as they can be. Soft T-shirt bra for an invisible look under clothes. A T-shirt bra has Black. Beige. Dark Blue. White. Keep Fresh bra. Multiway straps. Buy. Keep Fresh bra. A bra in the color of your skin tone should be in every woman's wardrobe. Underneath white or light clothing it will essentially be undetectable.

Black White Dark Flamingo Casual Comfort: For everyday wear, a black t-shirt bra or wireless bra offers seamless comfort under casual outfits. Here are some common types of black bras: 1. Black T-Shirt Bra: Designed for everyday wear, these bras offer a smooth and seamless look under T-shirts and other. Named for being the perfect plus size bra to wear underneath your favorite tee Our collection of plus size t-shirt bras covers the basics - black, white. A t-shirt bra offers smooth, seamless cups that will show no lines under your everyday t-shirt. Chantelle | C Jolie - C Jolie Wirefree T-Shirt Bra Black - 1. Jun 4, - Explore MAISON MAYBE's board "Black bra / White shirt" on Pinterest. See more ideas about how to wear, black bra white shirt, style. Of course! It's absolutely okay to wear a black bra under a white blouse if that's what makes you feel comfortable and confident. Fashion "rules. bra. My skin is light (true Winter) so I find most beige bras have too much yellow to be invisible under my white tops. My bra wardrobe is a light greyed. Wearing a white bra underneath really dark and black clothing also causes problems. The white penetrates the dark color, so you can see it underneath your. When you need all-day support that smooths your shape underneath your shirts, this is the bra you need in your top drawer collection. Whether you need full. Black/Body Beige Lining Latte Lift Black Almond Black The clean design eliminates bra lines, so it simply disappears under your favorite tees and more. Avoiding a white bra under a white shirt is crucial for maintaining a polished and seamless look. While it may seem intuitive to match the colours, the stark. Discover Pinterest's best ideas and inspiration for White shirt black bra outfits. Get inspired and try out new things. “There is no 'wrong color' bra to wear under white; it's all a question of style,” Adrienne says. “A beautiful bra with touches of lace can make a lovely. The smooth fabric and seamless design allows the Upbra T-Shirt Bra to be worn under thin shirts or dresses with confidence, and the patented Upbra ActiveLift®. However, we wouldn't recommend wearing a black bra under For everyday wear, black t-shirt bras lay smooth underneath shirts, dresses, blouses, and more. Find Black Bra White Shirt stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. Trust us, this will be your new favourite graphic Tee. Fabric & Details. White shirt with black design on front and back; Heavy weight gsm premium cotton. When you need all-day support that smooths your shape underneath your shirts, this is the bra you need in your top drawer collection. Whether you need full. If you are wearing a tight fitting top, choose a t-shirt bra to have a smoother look. Nude Bra Under White Clothes. Nude bras may feel like a safer option. Elegance Moulded Spacer T Shirt Bra. J Hook. Sculptresse. $ Best Seller Cari Moulded Spacer T Shirt Bra - White - __fanmal.ru · Cari Moulded Spacer T.

Option Trading Vs Futures Trading

A future is a contract to buy or sell an underlying stock or other assets at a pre-determined price on a specific date. On the other hand, options contract. Futures and options are financial derivatives that allow traders to speculate on the price movements of an underlying asset without actually owning it. Key advantages of trading futures versus stock options include a transparent trading experience, the ability to go long or short as needed, and a level. Why trade futures? · Around-the-clock trading opportunities · Direct market exposure · Capital efficiency · Potential tax benefits. In options trading, the buyer has a right, the seller has an obligation. An option buyer purchases the right, but not the obligation, to buy or sell the. Like the CFDs available at our fanmal.ru site, both futures and options can be used for a variety of assets, although they are all derivatives of the underlying. Futures contracts need you to buy or sell the commodity, whereas futures options allow you the right to buy or purchase the futures contract without having to. Options are one of the most important outgrowths of the futures market. Whereas a futures contract commits one party to deliver, and another to pay for, a. The main difference is that futures are traded through an exchange, whereas forwards are traded “over-the-counter” through a broker. Also, there are no. A future is a contract to buy or sell an underlying stock or other assets at a pre-determined price on a specific date. On the other hand, options contract. Futures and options are financial derivatives that allow traders to speculate on the price movements of an underlying asset without actually owning it. Key advantages of trading futures versus stock options include a transparent trading experience, the ability to go long or short as needed, and a level. Why trade futures? · Around-the-clock trading opportunities · Direct market exposure · Capital efficiency · Potential tax benefits. In options trading, the buyer has a right, the seller has an obligation. An option buyer purchases the right, but not the obligation, to buy or sell the. Like the CFDs available at our fanmal.ru site, both futures and options can be used for a variety of assets, although they are all derivatives of the underlying. Futures contracts need you to buy or sell the commodity, whereas futures options allow you the right to buy or purchase the futures contract without having to. Options are one of the most important outgrowths of the futures market. Whereas a futures contract commits one party to deliver, and another to pay for, a. The main difference is that futures are traded through an exchange, whereas forwards are traded “over-the-counter” through a broker. Also, there are no.

An options contract gives the buyer the right to buy the asset at a fixed price. Q. Can you make more money in futures versus options? A. Futures. An option is a subset of the futures market, and each option is specific to a certain commodity and futures month for that commodity. Options are similar to. The main difference between futures and options is that the buyer of the futures contract has the right and is also obligated to buy the. Learn how futures and options on futures can help you reach trading objectives with greater ease and effectiveness, and potentially lower costs. The key difference between the two is that futures require the contract holder to buy the underlying asset on a specific date in the future, while options -- as. The prime difference between options and futures is that futures need the contract holder to purchase the underlying assets such as commodities or stocks on a. Difference between Futures and Options Future and option trading are different in terms of obligations imposed on individuals. While futures act a liability. If you sell a futures contract, you are agreeing to sell the underlying asset at a specific price on a specific future date. In contrast, an option gives you. The fundamental difference between options and futures is in the obligations of the parties involved. The holder of an options contract has the right to buy the. Difference Between Options and Futures Trading · Options contracts are executed on the expiry date, offering the flexibility for traders to choose whether or not. Futures are a contract that the holder the right to buy or sell a certain asset at a specific price on a specified future date. Options give the right, but not. A futures contract will list an asset, delivery date, contract size, settlement method and settlement date. While futures trading is almost exclusive done. Trades in options on futures can include market neutral, multi-leg and directional trades depending on your market assumption and risk/reward goals. Using the. Commodity options. Commodity options give you the right, but not the obligation, to trade an underlying asset at a specific price – called the strike price –. Rights vs. obligations - When trading futures, both the buyer and the seller must settle the futures contract regardless of how the underlying asset price. An options contract gives the buyer the right to buy the asset at a fixed price. Q. Can you make more money in futures versus options? A. Futures. In case you wish to take a chance on futures and options, it would be less risky to begin your trades in options contracts. The potential to lose more in. Learn how futures and options on futures can help you reach trading objectives with greater ease and effectiveness, and potentially lower costs. The StoneX futures team helps clients reduce portfolio risk by utilizing options on their futures contracts. This strategy enables our clients to diversify risk. Futures options at $ per contract, per side · No platform fees · Free real-time market data.

Salesforce Customer Loyalty

Reimagine your brand loyalty program. Keep shoppers coming back with personalised experiences that drive lower costs and higher retention. Learn why Salesforce Loyalty Management is a top solution to build intelligent loyalty programs for both B2B and B2C customers. Loyalty Management, built on the Salesforce platform, helps organizations deliver innovative programs for customer recognition, reward, and retention. Loyalty. Gamified customer loyalty and social CRM platform. Integrates with Salesforce Sales Cloud, Google Analytics , Hotjar. While it is always important to bring in new business, your stable, returning customers are the ones who keep a business afloat. Customer loyalty is more than. Salesforce is a customer relationship management solution that brings customers and companies together. It's one integrated CRM platform that gives all your. A customer loyalty program is a marketing approach that recognizes and rewards customers who purchase or engage with a brand on a recurring basis. With Salesforce Loyalty Management customers can integrate loyalty across their business – Commerce, Service and Sales – to enhance the customer experience. Salesforce Loyalty Management enables you to use the power of the Salesforce Platform to create unified, cross-industry B2B and B2C loyalty programs. Reimagine your brand loyalty program. Keep shoppers coming back with personalised experiences that drive lower costs and higher retention. Learn why Salesforce Loyalty Management is a top solution to build intelligent loyalty programs for both B2B and B2C customers. Loyalty Management, built on the Salesforce platform, helps organizations deliver innovative programs for customer recognition, reward, and retention. Loyalty. Gamified customer loyalty and social CRM platform. Integrates with Salesforce Sales Cloud, Google Analytics , Hotjar. While it is always important to bring in new business, your stable, returning customers are the ones who keep a business afloat. Customer loyalty is more than. Salesforce is a customer relationship management solution that brings customers and companies together. It's one integrated CRM platform that gives all your. A customer loyalty program is a marketing approach that recognizes and rewards customers who purchase or engage with a brand on a recurring basis. With Salesforce Loyalty Management customers can integrate loyalty across their business – Commerce, Service and Sales – to enhance the customer experience. Salesforce Loyalty Management enables you to use the power of the Salesforce Platform to create unified, cross-industry B2B and B2C loyalty programs.

How to win Loyal Customer? · Top Loyalty Program Tools Compared: Which is Best? · How to Create a Successful Loyalty Program with Salesforce. Salesforce unveiled Loyalty Management, aiming to assist businesses in actively engaging and rewarding their customers. Employing a user-friendly interface. customers achieve new loyalty tiers. Loyalty Management Implementation: Choose Salesforce as your top-notch CRM platform to elevate customer satisfaction. Use your customer data for an optimal experience for your customers: thanks to personalisation and automation. Generate automated campaigns that are ideally. When defining customer loyalty, many would agree that it's a measure of how likely a customer is to engage with a business or brand on a repeat basis. Salesforce-loyalty-management software helps businesses engage meaningfully with customers. Customer loyalty is built through advanced management tools. Salesforce Loyalty Management is a great software to manage customer loyalty programs, we are using it to enhance customer engagement and increase customer. Get AI insights with a complete analytics platform for loyalty management. $ USD/user/month* (billed annually). Salesforce can help you with Loyalty Management, a complex loyalty solution built on the Salesforce Customer Platform. Create a B2B or a B2C loyalty program to enhance the business value for loyal customers and channel partners. Using a CRM, companies are able to achieve full multi-channel campaign management from one place, tracking interactions with the brand, points accumulation. Loyalty Management Pricing. Easily build, deploy, track, and manage your customer loyalty program across teams, organizations, and partners. Purpose-built to work with Sales Cloud and Service Cloud or integrate with your existing CRM, Loyalty Management is a flexible end-to end solution. With full. In today's competitive landscape, customer loyalty is no longer a nice-to-have, it's a business imperative. Studies show that loyal. PwC and Salesforce are teaming up to bring you a tech-enabled service built to help transform your traditional loyalty program into a new customer loyalty. Salesforce Loyalty Management helps organizations deliver innovative programs for customer recognition, reward, and retention. Salesforce Loyalty Cloud is a game-changer for businesses looking to elevate their customer loyalty programs and drive operational excellence. Zinrelo is the Top Salesforce Partner for Loyalty Programs As a trusted and certified partner of Salesforce Commerce Cloud, Zinrelo offers a seamless. Why is a Customer Loyalty Program Important? Loyalty programs are effective tools to encourage your customers to stay in business with you. By rewarding.

Lowest Auto Finance Rates

Vehicle loan rates with the fanmal.ru discount currently as low as % APR, depending on credit history, loan term and vehicle model year. Rates as low as % APR*; Loans for new and used autos; Purchases and refinances; Concierge style car buying services. Additional Benefits. Skip two loan. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. Auto Loan Rates ; – · 76 – 84 Months, As low as % ; – , Up to 48 Months, As low as % ; – · 49 – 63 Months, As low as % ; banks pull. volt is where the smart people come for their auto loans. But don't worry, it's not too late to switch to a volt loan and lower your rates! New Vehicle Loans ; months, as low as %**, $ per $1, ; months, as low as %**, $ per $1, ; months, as low as %**. Best Auto Loan Rates in September Credit union car loans tend to offer the lowest rates, and Southeast Financial Credit Union (SFCU) is no exception. Shop, finance and drive. Find the car and financing that's right for you. Get a fast credit decision, competitive rates with a 30 day rate lock. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Vehicle loan rates with the fanmal.ru discount currently as low as % APR, depending on credit history, loan term and vehicle model year. Rates as low as % APR*; Loans for new and used autos; Purchases and refinances; Concierge style car buying services. Additional Benefits. Skip two loan. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. Auto Loan Rates ; – · 76 – 84 Months, As low as % ; – , Up to 48 Months, As low as % ; – · 49 – 63 Months, As low as % ; banks pull. volt is where the smart people come for their auto loans. But don't worry, it's not too late to switch to a volt loan and lower your rates! New Vehicle Loans ; months, as low as %**, $ per $1, ; months, as low as %**, $ per $1, ; months, as low as %**. Best Auto Loan Rates in September Credit union car loans tend to offer the lowest rates, and Southeast Financial Credit Union (SFCU) is no exception. Shop, finance and drive. Find the car and financing that's right for you. Get a fast credit decision, competitive rates with a 30 day rate lock. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or.

New and Used Auto / Truck Loans ; Minimum Loan Amount · Terms up to · Annual Percentage Rate, Payment per $ ; $1,, 60 months, %, $ ; $20,, Auto Loan Rates (new & used) ; %, months, % ; %, months, % ; %, months, % ; %, months ($18, Rates are the lowest rates available and are determined by individual creditworthiness. Other rates and terms available. Whether you want to finance a car that's used, new, fueled, or electric, we offer competitive rates that put you in the driver's seat in no time. Auto loan rates as low as % APR for new vehicles. Apply Nowfor an auto loan. Today's New & Used Car Loan Rates. Rates Table. Loan Type. GET MORE MILEAGE OUT OF YOUR BUDGET WITH OUR AFFORDABLE NEW & USED AUTO LOANS · % APR* · % APR* · Let's get going! · Benefits of Credit Union Auto Loans. Fixed auto loan interest rates as low as % APR (OAC) with MyStyle® Checking discount; No application fees; Terms up to 72 months (6 years)⁴; Onsite. Secure the lowest auto loan rates so you can pay off your loan faster; Reduce your payment and save money while paying off your car loan; Choose new terms. Vehicle Loan Rates ; & Newer, %, % ; & Newer, %, %. Fixed auto loan interest rates as low as % APR (OAC) with MyStyle® Checking discount; No application fees; Terms up to 72 months (6 years)⁴; Onsite. KEMBA Financial Credit Union in Central OH makes it easy for you to view our low auto loan rates. Visit our website today to use our auto rate calculator. 1. Determine your budget · 2. Check your credit · 3. Do your research · 4. Apply for preapproval and shop for your car · 5. Compare car loan quotes · 6. Read the. Auto loan rates as low as % APR for used vehicles with a maximum age of 10 years with less than , miles. Income subject to verification. Must use auto. Get a lower auto loan refinancing rate. Save big by securing your auto loan before you head to the dealership. Loan rates as low as %! interest rate. The lowest rate is available for loans that do not exceed 90% of the vehicle's value. Should I finance a car through the dealer or credit union? Auto Loan Rates ; APR1 As Low As ; New or Used Auto Loan (Less Than 2 Years Old). APR1 As Low As. % ; Used Auto Loan (2 – 6 Years Old). APR1 As Low As. %. Let us do the shopping for you. Get discounted pricing and our best rates on your next vehicle purchase in partnership with TrueCar. Rates starting at % APR. Auto loans are available now on new and used cars through AAA. Auto loan rates as low as %. Talk with us & find out more about our car finance options. Auto Loan Refinancing · Refi Rates as Low as % APR for New Vehicles · Refi Rates as Low as % APR for New Vehicles · Today's Auto Refinance Loan Rates · Why. auto loan rates online Lowest Auto Rate. Save big on your next purchase or refinance. Apply NowMore.

Technical Trading Patterns

Traditional chart patterns are a visual representation of historical price movements in the market. While no trading strategy can predict the future with %. Searching for Patterns in Daily Stock Data: First Steps Towards Data-Driven Technical Analysis Chart patterns are a commonly-used tool in the analysis of. There are three key chart patterns used by technical analysis experts. These are traditional chart patterns, harmonic patterns and candlestick patterns (which. A broadening top is a futures chart pattern that can occur on an upwards trend. It is generally classified as a reversal pattern but some traders argue that. In technical analysis, the distinctive formation created by the movement of security prices on a chart. It is identified by a line connecting common price. Technical analysts may look at patterns in price to determine whether a trend will continue or if a reversal in trend is possible. · Traders look to identify a. Most Important Stock Chart Patterns · Ascending Triangle Pattern · Symmetrical Triangle Patterns · Descending Triangle Pattern · Bump and Run Reversal Pattern · Cup. There are two main categories of chart patterns: continuation patterns and reversal patterns. Continuation patterns indicate a continuation of the current trend. Identify the various types of technical indicators, including trend, momentum, volume, volatility, and support and resistance. Use charts and learn chart. Traditional chart patterns are a visual representation of historical price movements in the market. While no trading strategy can predict the future with %. Searching for Patterns in Daily Stock Data: First Steps Towards Data-Driven Technical Analysis Chart patterns are a commonly-used tool in the analysis of. There are three key chart patterns used by technical analysis experts. These are traditional chart patterns, harmonic patterns and candlestick patterns (which. A broadening top is a futures chart pattern that can occur on an upwards trend. It is generally classified as a reversal pattern but some traders argue that. In technical analysis, the distinctive formation created by the movement of security prices on a chart. It is identified by a line connecting common price. Technical analysts may look at patterns in price to determine whether a trend will continue or if a reversal in trend is possible. · Traders look to identify a. Most Important Stock Chart Patterns · Ascending Triangle Pattern · Symmetrical Triangle Patterns · Descending Triangle Pattern · Bump and Run Reversal Pattern · Cup. There are two main categories of chart patterns: continuation patterns and reversal patterns. Continuation patterns indicate a continuation of the current trend. Identify the various types of technical indicators, including trend, momentum, volume, volatility, and support and resistance. Use charts and learn chart.

How to Use This Pattern · Traders wait for a critical price level called the “neckline” to be broken. · This neckline connects the low points between the two. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. How to. In this program we have cover some of the most popular Technical Indictors and Chart Patterns with some live cases studies. Chart patterns are a popular method used in technical analysis to analyse and predict price movements in the financial markets. Traders and investors use. 11 chart patterns for trading · 1. Ascending and descending staircase · 2. Ascending triangle · 3. Descending triangle · 4. Symmetrical triangle · 5. Flag · 6. Wedge. The answer though, could very well be found in technical analysis. It's been suggested time and time again, that technical analysis is indeed the most reliable. The Wyckoff Accumulation pattern is a widely recognized chart pattern in technical analysis that helps traders identify potential market reversals and breakouts. The head-and-shoulders pattern is one of the most popular chart patterns in technical analysis and indicates that a reversal is likely to happen after the. Just as technical indicators such as volume, support and resistance levels, RSI, and Fibonacci retracements can help your technical analysis trading, stock. Chart patterns trading is often equated to buying and selling at the direction of technical indicators. However, although chart patterns are considered to be. The Complete Guide to Technical Analysis Patterns, Including Graphs, Know All Forms of Price Patterns and how to use these trading patterns. Commonly used technical indicators and charting patterns include trendlines, channels, moving averages, and momentum indicators. In general, technical analysts. Stock Chart Patterns is an essential guide for traders and investors seeking to understand and utilize technical analysis in the financial markets. Chart patterns are formations appearing on price charts that create some type of recognizable shape. There are two major types of chart patterns: reversal. Overall, patterns work often but not always % I think other variables should inform your decision to trade a pattern you recognize because. Understanding Chart Patterns: A Guide to Technical Analysis with ChainGPT AI Trading Assistant Technical analysis, particularly the. Reversal chart patterns are technical indicators that traders use to identify potential buying and selling opportunities in the markets. Reversal chart patterns. Technical analysts may look at patterns in price to determine whether a trend will continue or if a reversal in trend is possible. · Traders look to identify a. Chart patterns are very useful in confirming the indications of other technical analysis tools such as MACD or RSI. Triangles are very common patterns in the. A chart pattern or price pattern is a pattern within a chart when prices are graphed. In stock and commodity markets trading, chart pattern studies play a.

How Hard To Refinance Mortgage

Steps to Refinance Your Mortgage · Determine if refinancing makes financial sense for you. · Shop around for the best rates and compare lenders. · Apply to. If interest rates are down, it could be a good time to consider refinancing. It's nearly impossible to predict when interest rates on mortgage refinancing will. Refinancing will be more difficult if your home value plummets and puts your mortgage under water. If you are in a conventional mortgage you. To apply for refinancing, you will need to do some of the same things you did when you got the mortgage to buy your home. This includes proving your identity. You can refi as long as the equity of the investment is acceptable to the lender. A lot of banks like to only loan 80% of value. And if you have little to no home equity, fear not — it's not impossible to refinance a mortgage. In fact, depending on when you got your mortgage and what. 4. Impact on Credit Score Each time you refinance, the lender will conduct a hard inquiry of your credit. Too many of these types of examinations can. The new lender wouldn't care what the current loan is, as long as it's paid off. Assuming you execute the project properly and the rents support the mortgage. However, remember that when you apply for a loan and the potential lender reviews your credit history, it results in a “hard inquiry” on your credit reports. Steps to Refinance Your Mortgage · Determine if refinancing makes financial sense for you. · Shop around for the best rates and compare lenders. · Apply to. If interest rates are down, it could be a good time to consider refinancing. It's nearly impossible to predict when interest rates on mortgage refinancing will. Refinancing will be more difficult if your home value plummets and puts your mortgage under water. If you are in a conventional mortgage you. To apply for refinancing, you will need to do some of the same things you did when you got the mortgage to buy your home. This includes proving your identity. You can refi as long as the equity of the investment is acceptable to the lender. A lot of banks like to only loan 80% of value. And if you have little to no home equity, fear not — it's not impossible to refinance a mortgage. In fact, depending on when you got your mortgage and what. 4. Impact on Credit Score Each time you refinance, the lender will conduct a hard inquiry of your credit. Too many of these types of examinations can. The new lender wouldn't care what the current loan is, as long as it's paid off. Assuming you execute the project properly and the rents support the mortgage. However, remember that when you apply for a loan and the potential lender reviews your credit history, it results in a “hard inquiry” on your credit reports.

Credit score impact. Applying for refinancing requires a hard inquiry on your credit report, which could temporarily lower your score. · Length of the loan. In any case, it is probably more advantageous to get an equity loan or line of credit. Refinancing a mortgage incurs significant costs in terms. If your home has increased in value or if you have paid enough into your home so that you owe less than 80% of what it's worth, you can refinance into a new. Finally, although only temporary, refinancing your mortgage could have a negative impact on your credit score as the lender will perform a hard inquiry to. In this case, it can be difficult to be approved for a refinance loan. You may also be denied if your home is in poor condition, or if you made improvements. Refinancing a mortgage usually costs between 3% and 6% of the total loan amount, but borrowers can find several ways to reduce the costs (or wrap them into the. Apply for your mortgage. When a mortgage professional reviews your application, they'll do a hard pull on your credit in order to evaluate your worthiness. Freedom Mortgage may be able to offer you a refinance interest rate that's lower or higher than the rate you see offered by other lenders. The rate you may. Refinancing your mortgage typically means replacing your mortgage with a new one, under different terms. Your lender typically “pays off” your current. Similar to when you purchased your home, the costs to refinance your mortgage include a loan origination fee, an appraisal fee, closing costs, title and. FHA loans also include mortgage insurance premiums. Once you have 20% equity in your home, you may be able to refinance your FHA loan to a conventional loan. Refinancing a home loan requires paying for a variety of things, including closing costs, that can add up to a decent chunk of change. If you refinance and then. Most homeowners refinance to lower their rate and monthly payments. There are no hard-and-fast mortgage rules about how much interest rates need to drop for you. A simplified online application makes it easier to apply for a mortgage refinance with Wells Fargo. Use our refinance calculator to find your rate. If you have an adjustable rate mortgage, opting instead for a fixed-rate loan can make it easier to budget with set monthly payments. Consolidate. By rolling. Learn more about your mortgage refinancing options, view today's rates and use our refinance calculator to help find the right loan for you. Refinancing a house means you replace the mortgage you have with a new mortgage that has more favorable terms. Whether or not you should refinance depends on. 3% equity option. If you already have a Fannie Mae-owned loan, you can refinance with as little as 3% equity. If your mortgage isn't owned by Fannie Mae, you. A general guideline for determining whether you should refinance your mortgage is that you should do it only if you can lower your interest rate by at least. Home equity loans and liens. It's more difficult to get approved for refinancing if you have a home equity loan or lien on your house. You'll probably need.

Income Producing Assets For Sale

There are several income-producing assets you could consider investing in with under $ 1> Dividend-Paying Stocks: Invest in. In many cases, selling your assets earlier than expected results in a severe financial loss that puts you back behind the eight-ball in terms of your finances. The most common income generating asset is a nice, big fat stock portfolio full of dividend stocks. Stocks are usually invested in for long term appreciation in. The closest thing to a passive income that most people can reach for is a large investment portfolio that you can sell portions of for the income you want to. This created a disincentive to sell assets, because no credit was given for the sale proceeds and the loss of future receipts from income producing assets was. Through our unique marketplace, you can now build a portfolio of uncorrelated, yield-generating royalties with a documented track record of consistent income. Best Income Generating Assets / Assets to Buy. Assets That Generate Income · Real Estate · Stocks · Savings Accounts · Certificates Of. Q&A: Opening a Franchise, Selling a New Product, and Income-Producing Assets · Should I sell my k holdings? · How do I avoid paying $K for college? · My San. Why buy an SUV, if a subcompact car is enough for your transportation requirements? 1 tire of an SUV has the equivalent costs of 4 tires of a. There are several income-producing assets you could consider investing in with under $ 1> Dividend-Paying Stocks: Invest in. In many cases, selling your assets earlier than expected results in a severe financial loss that puts you back behind the eight-ball in terms of your finances. The most common income generating asset is a nice, big fat stock portfolio full of dividend stocks. Stocks are usually invested in for long term appreciation in. The closest thing to a passive income that most people can reach for is a large investment portfolio that you can sell portions of for the income you want to. This created a disincentive to sell assets, because no credit was given for the sale proceeds and the loss of future receipts from income producing assets was. Through our unique marketplace, you can now build a portfolio of uncorrelated, yield-generating royalties with a documented track record of consistent income. Best Income Generating Assets / Assets to Buy. Assets That Generate Income · Real Estate · Stocks · Savings Accounts · Certificates Of. Q&A: Opening a Franchise, Selling a New Product, and Income-Producing Assets · Should I sell my k holdings? · How do I avoid paying $K for college? · My San. Why buy an SUV, if a subcompact car is enough for your transportation requirements? 1 tire of an SUV has the equivalent costs of 4 tires of a.

sale of all classes of income producing assets in seven southeastern states. From value-add properties to fully-stabilized assets, our specialized advisors. Selling certain assets among generations, rather than gifting, can be used to preserve lifetime gift and estate tax exclusion. · Transferring a share of an asset. likes, 14 comments - mathistwins on December 21, "The Goal: Generational wealth!. The How: Buy income producing assets! Private real estate focuses on commercial, income-generating properties across a wide range of assets from warehouses and multifamily housing to office, hotel. 7 income producing assets that you already own · 1. The house or apartment you live in – Airbnb · 2. Your car as an income-producing asset – ride-sharing services. Recurring Revenue of $5,+ per month Sale Price $, Frisco income-producing Walkaloosa Property. Starting production in May Tap into over fifty years of real estate investment experience with an income-producing, institutional quality REIT, J.P. Morgan Real Estate Income Trust. These can come in many forms, such as rental properties, dividend-paying stocks, bonds, and mutual funds. The goal of income-producing assets is to create a. producing asset from their lower income spouse for fair market value. The lower income spouse then invests the sale proceeds. This strategy allows the. income-producing real estate assets in trust. It can be relatively easy for Not only may the sale of other trust assets expose the trust to other. There are several income-producing assets you can consider with an investment of under $50, · 1> Dividend-Paying Stocks: Invest in. Book overview · Royalties: Learn how to create and license intellectual property, such as books, music, and patents, to earn ongoing royalties. · Rental Income. Real estate investments can also produce income from rents or mortgage payments in addition to the potential for capital gains. What Is Direct vs. Indirect Real. , Income Producing Assets, for a full discussion on the treatment of income producing assets. real estate and gifted the funds from the sale to family. Income producing assets is what it's all about in a low interest rate environment. Eventually, interest rates will come down again and risk asets will. The best way to accumulate wealth in your 20s is to buy assets and avoid liabilities. An asset is anything that tends to increase in value. In asset building, you spend time building or gathering an income-generating asset income by selling it. Asset sharing means using something you. A REIT is a company that owns and typically operates income-producing real estate or related assets. These may include office buildings, shopping malls. income-producing real estate across a range of property sectors. Read more here selling of assets to build value throughout long-term real estate cycles. They say, "Money can't buy happiness," but you know what it can buy? Income-producing assets—and those will give you a lifetime supply of.

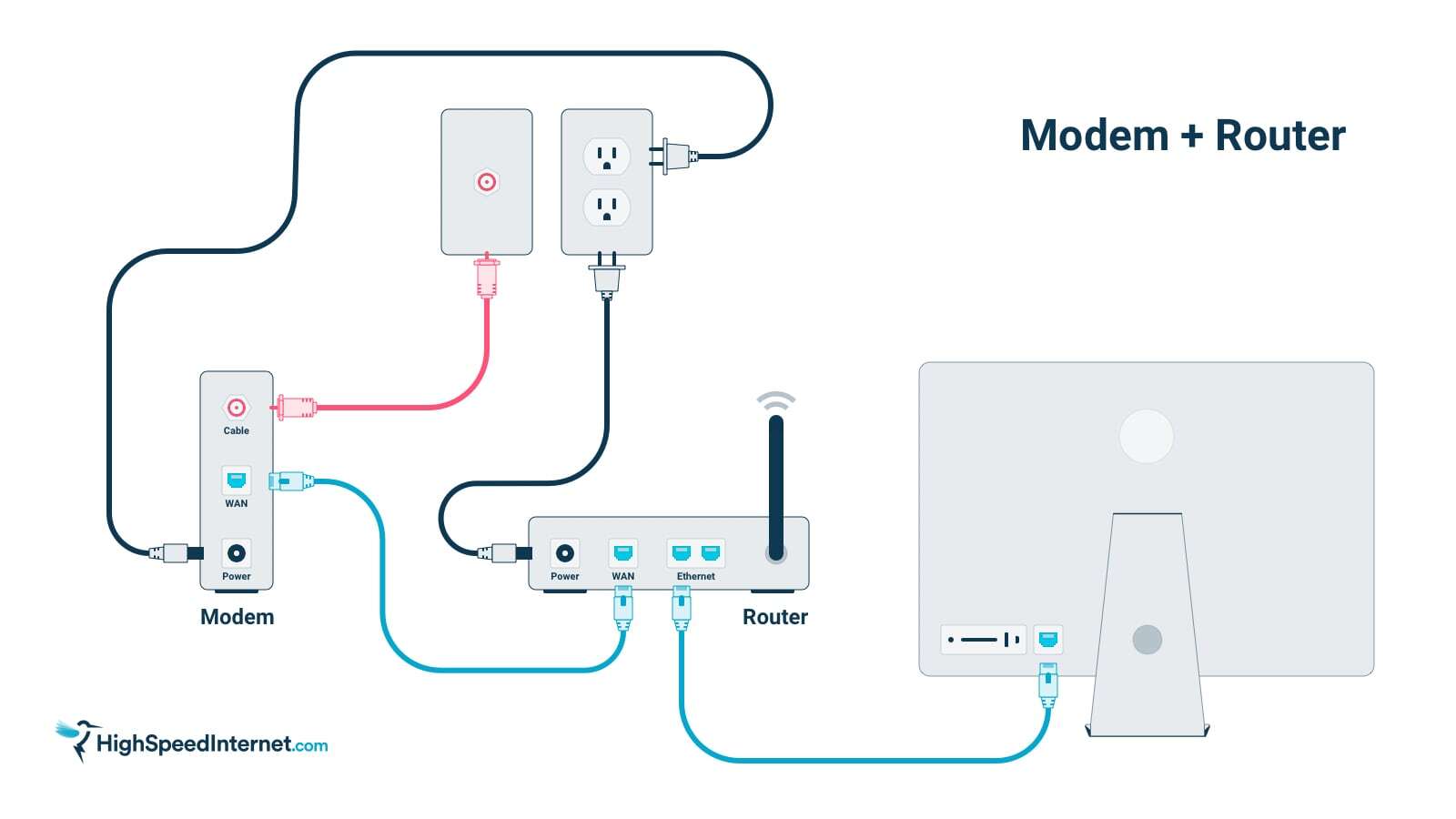

Do I Need An Ethernet Cable If I Have Wifi

For example, if you have a Windows Laptop with both Wi-Fi and Ethernet connections up and running. What Windows does is it prioritizes one connection over the. Having a wired network allows me to have a private, high speed, network at home for Internet access, file sharing, media streaming, online gaming (console or PC). Well, if it's a Wi-Fi router then you don't really need an Ethernet port on your computer. As long as your computer can connect to Wi-Fi, you. Network cable, also known as internet cable, is often confused with ethernet cable because they both transmit data via a wired connection. Network cables do not. You don't need an Ethernet cable to use a Wi-Fi booster like Wi-Fi extenders Likewise, wireless extenders often have antennas that need to be in direct. If you prefer wired backhaul, these devices have Ethernet ports that let you physically connect them together. Here are some possible setups you can do. A lot of times, there will also be a Wireless network related device. However that may be, Ethernet cables will continue to be used to wire up devices that need. You can also use coaxial wiring in your home for reliable wired connection. If you use Ethernet cables, all you have to do is connect one end of the cable to. It's a wired connection that requires either coaxial or fiber-optic cables plugged directly into your router, which can be inconvenient, but provides a more. For example, if you have a Windows Laptop with both Wi-Fi and Ethernet connections up and running. What Windows does is it prioritizes one connection over the. Having a wired network allows me to have a private, high speed, network at home for Internet access, file sharing, media streaming, online gaming (console or PC). Well, if it's a Wi-Fi router then you don't really need an Ethernet port on your computer. As long as your computer can connect to Wi-Fi, you. Network cable, also known as internet cable, is often confused with ethernet cable because they both transmit data via a wired connection. Network cables do not. You don't need an Ethernet cable to use a Wi-Fi booster like Wi-Fi extenders Likewise, wireless extenders often have antennas that need to be in direct. If you prefer wired backhaul, these devices have Ethernet ports that let you physically connect them together. Here are some possible setups you can do. A lot of times, there will also be a Wireless network related device. However that may be, Ethernet cables will continue to be used to wire up devices that need. You can also use coaxial wiring in your home for reliable wired connection. If you use Ethernet cables, all you have to do is connect one end of the cable to. It's a wired connection that requires either coaxial or fiber-optic cables plugged directly into your router, which can be inconvenient, but provides a more.

The whole point of Ethernet, is that it's a wired internet connection. If you use ethernet, you no longer need a wireless connection. In fact, a wired. Additionally, Ethernet cables typically (though not always) have higher maximum bandwidth than Wi-Fi routers, so higher speeds are possible (if your internet. You don't necessarily need to use a cable. If your internet use is limited to general stuff, then you shouldn't have an issue. The short answer is a hardware ethernet is almost always better, although it means you have to be tethered. If you can work with the tether, it. If your wireless connections is insufficient, you should use a wired connection using an ethernet cable. It is usually a better idea to plug into a wired. You don't need an Ethernet cable to use a Wi-Fi booster like Wi-Fi extenders. However, there's good reason to use one. Learn more. If one Ethernet cable doesn't work and you have another one nearby, try the other Ethernet cable to see if that works. If it does, it might be a problem with. A fixed Ethernet connection is likely to be fast, stable, and deliver consistent speeds. It's something you'll notice the benefit of if you download large files. When the technician installed the new Giga Hub, he did not re-connect (or apparently test) the Ethernet cables and apparently said he was in a hurry (I get it. Many people are installing ethernet cables to support their WiFi with their internet demands. If a specific device needs to be prioritised for file sharing. You don't need an Ethernet cable to use a Wi-Fi booster like Wi-Fi extenders Likewise, wireless extenders often have antennas that need to be in direct. Fiber internet doesn't need a modem, but it does require a router. Skip this step and jump to the next section on routers if you have a fiber setup. graphic of. If you find them, you're in luck! All you need to do is connect your devices using Ethernet cables. Step 2: Determine Your Network Needs Based on Devices &. Last but not least, you should always use ethernet connections when you need to ensure complete security of your stream. With ethernet connections only being. The first option is over WiFi. This allows connection to the internet over a greater distance, and eliminates the need for trailing wires in your room. How to. Last but not least, you should always use ethernet connections when you need to ensure complete security of your stream. With ethernet connections only being. Typically, you'll only need an Ethernet cable to connect to the modem and get internet, regardless of whether it's dial-up, DSL or cable. On the other hand. If you sometimes need Wi-Fi you can purchase a Wi-Fi router separately and then turn the router on and off as needed. Wired Router with LAN Ethernet Ports: A. Some devices can connect to your internet service using an Ethernet cable—a "wired" as opposed to a "wireless" connection. Understanding the differences is key. You'll need an internet connection to finish setting up a device running Windows 10 Home or Windows 11 Home / Pro. If you have problems getting connected to the.

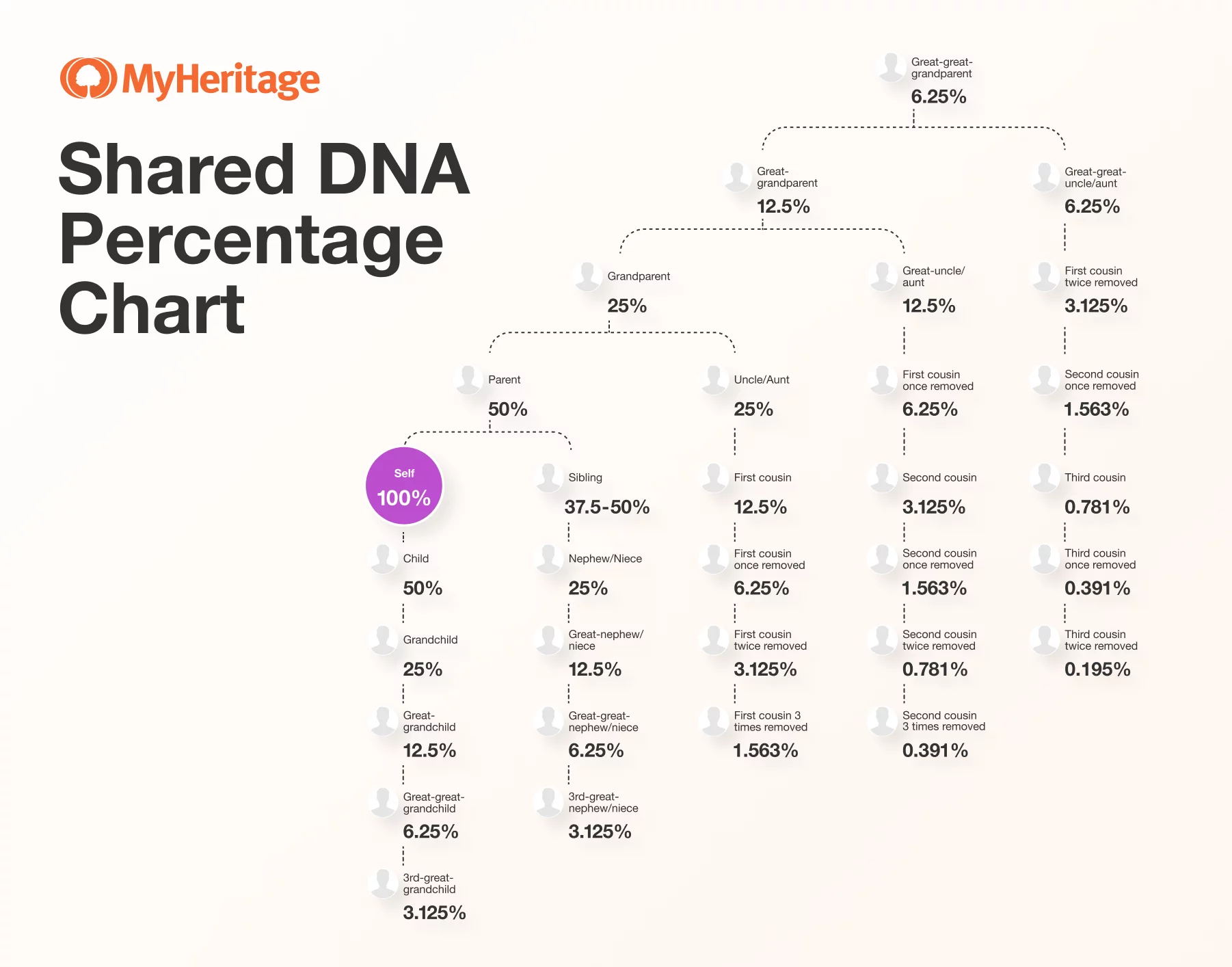

Dna Shares

See the latest DNA Stock price for Ginkgo Bioworks Holdings Inc and NYSE: DNA stock rating, related news, valuation, dividends and more to help you make. Ginkgo Bioworks Holdings Inc (DNA) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change View the real-time DNA price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Since the human genome was first sequenced in , the field of comparative genomics has revealed that we share common DNA with many other living organisms. According to Ginkgo Bioworks 's latest financial reports and stock price the company's current number of shares outstanding is 2,,, At the end of Ginkgo Bioworks Holdings Inc. ; Volume, M ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A. Get Ginkgo Bioworks Holdings Inc (DNA.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Real time Ginkgo Bioworks (DNA) stock price quote, stock graph, news & analysis. See the latest DNA Stock price for Ginkgo Bioworks Holdings Inc and NYSE: DNA stock rating, related news, valuation, dividends and more to help you make. Ginkgo Bioworks Holdings Inc (DNA) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Key Stats · Market CapM · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change View the real-time DNA price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Since the human genome was first sequenced in , the field of comparative genomics has revealed that we share common DNA with many other living organisms. According to Ginkgo Bioworks 's latest financial reports and stock price the company's current number of shares outstanding is 2,,, At the end of Ginkgo Bioworks Holdings Inc. ; Volume, M ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A. Get Ginkgo Bioworks Holdings Inc (DNA.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Real time Ginkgo Bioworks (DNA) stock price quote, stock graph, news & analysis.

Shares Out. MM. Earnings Date, EPS (TTM), Dividend Yield. This metric excludes the company's treasury shares. Compare DNA With Other Stocks. About Ginkgo Bioworks Holdings Inc - Ordinary Shares - Class A Ginkgo Bioworks Holdings, Inc. is a biotech company. Its platform is market agnostic and. Get the latest Ginkgo Bioworks Holdings Inc. Class A (DNA) stock price, news, buy or sell recommendation, and investing advice from Wall Street. Discover real-time Ginkgo Bioworks Holdings, Inc. Class A Common Stock (DNA) stock prices, quotes, historical data, news, and Insights for informed trading. Ginkgo Bioworks Holdings Inc. analyst ratings, historical stock prices, earnings estimates & actuals. DNA updated stock price target summary. Track Ginkgo Bioworks Holdings Inc - Ordinary Shares - Class A (DNA) Stock Price, Quote, latest community messages, chart, news and other stock related. Find the latest institutional holdings data for Ginkgo Bioworks Holdings, Inc. Class A Common Stock (DNA) including shareholders, ownership summaries. DNA has underperformed the market in the last year with a price return of % while the SPY ETF gained +%. DNA has also underperformed the stock market. (NYSE: DNA) Ginkgo Bioworks Holdings currently has 55,, outstanding shares. With Ginkgo Bioworks Holdings stock trading at $ per share, the total. The current price of DNA is USD — it has decreased by −% in the past 24 hours. Watch Ginkgo Bioworks Holdings, Inc. stock price performance more. Ginkgo Bioworks Holdings, Inc. (US:DNA) has institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission. Ginkgo Bioworks Holdings (DNA) has a Smart Score of 1 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. A high-level overview of Ginkgo Bioworks Holdings, Inc. (DNA) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. View Ginkgo Bioworks Holdings, Inc. Class A DNA stock quote prices, financial information, real-time forecasts, and company news from CNN. Stock analysis for Ginkgo Bioworks Holdings Inc (DNA:New York) including stock price, stock chart, company news, key statistics, fundamentals and company. Thinking of buying or selling Ginkgo Bioworks Holdings stock that's listed in a currency different from your local one? Use our international stock ticker. View the DNA premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Ginkgo Bioworks Holdings. Get the latest Ginkgo Bioworks Holdings Inc (DNA) real-time quote, historical performance, charts, and other financial information to help you make more. Ginkgo Bioworks (DNA) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong.

Whats Kyc In Banking

KYC helps banks to comply with Anti-Money Laundering regulations and prevent fraud. The aim of KYC is to protect both the bank and the wider financial markets. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is a critical component of banking operations. Know Your Customer (KYC) procedures are used to verify a customer's identity, assess the nature of financial activities and determine if there are money. Know Your Customer (KYC) processes are pivotal across a myriad of industries, not just within banking but also extending to insurance, healthcare, and more. KYC in Banking is the process of identifying and verifying customer identity while opening a bank account and during the course of business. The purpose of KYC. It is essentially the customer due diligence that regulated entities, such as banks, are required to undertake to assess and monitor the risk associated with a. KYC, or "Know Your Customer", is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and. KYC refers to the checks that banks (and other organizations) must carry out to establish a customer is who they claim to be, and involves verifying the. Know Your Customer (KYC) procedures are a legal requirement for banks and financial institutions to know who they're doing business with. KYC helps banks to comply with Anti-Money Laundering regulations and prevent fraud. The aim of KYC is to protect both the bank and the wider financial markets. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is a critical component of banking operations. Know Your Customer (KYC) procedures are used to verify a customer's identity, assess the nature of financial activities and determine if there are money. Know Your Customer (KYC) processes are pivotal across a myriad of industries, not just within banking but also extending to insurance, healthcare, and more. KYC in Banking is the process of identifying and verifying customer identity while opening a bank account and during the course of business. The purpose of KYC. It is essentially the customer due diligence that regulated entities, such as banks, are required to undertake to assess and monitor the risk associated with a. KYC, or "Know Your Customer", is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and. KYC refers to the checks that banks (and other organizations) must carry out to establish a customer is who they claim to be, and involves verifying the. Know Your Customer (KYC) procedures are a legal requirement for banks and financial institutions to know who they're doing business with.

KYC is a process that banks use in the KYC compliance program to document and verify customer information. KYC Compliance provides benefits to both the bank and. Know your customer (KYC) guidelines and regulations in financial services require professionals to verify the identity, suitability, and risks involved with. KYC means to 'know your customer' which is an effective way for an institution to confirm and thereby verify the authenticity of a customer. Who is obliged to comply with KYC regulations? · Financial industry (Banks, insurance companies, brokerage houses, mortgage houses, etc.) · Fintech (crypto. This business brief provides an overview of the new approach to performing customer due diligence or perpetual KYC, including the drivers and challenges. KYC verification is a crucial part of the customer due diligence (CDD) process and involves ensuring that a customer is who they say they are and can be trusted. KYC is a set of regulations and procedures that verify a customer's identity. It says that financial institutions need to make a reasonable effort to keep. KYC requirements for banks ensure advisors are aware of their clients' financial situation and risk tolerance to avoid the possibility of fraud. Know Your Customer (KYC), is a set of guidelines within the financial industry designed to protect banks and financial services from fraud and money laundering. KYC is a standard banking practice adopted globally to verify the identity of clients. It is the cornerstone of a robust anti-money laundering (AML) and counter. Know Your Customer is the process of verifying the identity of customer. The objective of KYC guidelines is to prevent banks from being used. Banks are required to periodically update KYC records. This is a part of the ongoing due diligence on bank accounts. The periodicity of such updation would vary. What is the Difference Between CIP and KYC in Banking? Know Your Customer (KYC) and Customer Identification Procedures (CIP) are vital for business operations. In the financial industry, Know Your Customer or Know Your Client (KYC) is a set of guidelines for verifying the identity of a customer and gauging the. What is the purpose of KYC in banking? · Identity theft: By requiring and verifying approved KYC documents, banks make it more difficult for someone's identity. KYC's full form is Know Your Customer. It is a crucial process ensuring banks identify and verify clients' identities during account opening and periodically. KYC is a regulatory requirement that banks must adhere to prevent financial crimes and ensure the safety of customer funds. What is KYC? Know Your Customer (KYC) refers to the process of verifying the identity of your customers, Ultimate Beneficial Owners (UBOs) and third-party. The Know Your Customer (KYC) process helps banks and financial institutions prevent financial crime while improving onboarding speed for customers. KYC Documents Required · Utility bills, such as telephone, electricity, gas, etc. · Bank statements · Employment documents · Housing contracts and rent agreements.

1 2 3 4 5 6